风萧萧_Frank

以文会友5 Things U.S. Policymakers Must Understand About China-Africa Relations

Jordan Link

Jordan Link

The United States must focus on developing a positive vision for the future of its role in Africa rather than relying solely on criticizing China’s engagement on the continent.

Restoring Social Trust in Democracy, Africa, Asia-Pacific

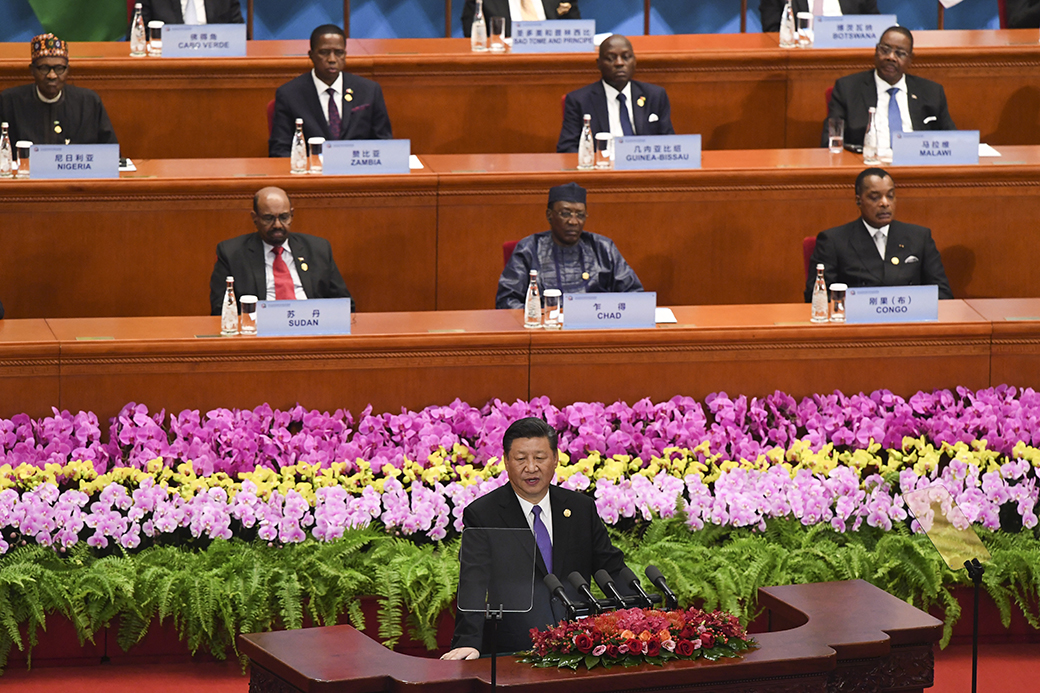

Chinese President Xi Jinping, front center, gives a speech during the opening ceremony of the Forum on China-Africa Cooperation at the Great Hall of the People, September 3, 2018, in Beijing. (Getty/Madoka Ikegami)

Introduction and summary

The eighth convening of the Forum on China-Africa Cooperation (FOCAC), likely to be held late this year, marks more than 20 years of high-level and institutionalized dialogue between Beijing and African leaders. The forum serves as a joint platform allowing Chinese and African officials to formulate how Chinese engagement can support African development goals and other ongoing initiatives. Over the years, Chinese leaders have used FOCAC to announce pledges for development financing in Africa.

U.S. policymakers on both sides of the aisle have grown more anxious about Beijing’s role on the African continent as China-Africa relations have deepened in a variety of areas, including trade and commercial ties, military-security relations, and technology. However, American policymakers across the political spectrum have not prioritized African countries when it comes to U.S. foreign policy plans. Rather, Washington’s limited focus on Africa has lacked coordination and now is often unsettled by an ill-defined concept of “Chinese influence.” When former President Donald Trump’s administration unveiled a new strategy for Africa, it framed the continent as a venue for competition with Beijing, rather than offering a positive vision for U.S.-Africa relations.1 The Biden administration has sought to refocus the Trump administration’s Prosper Africa initiative, a campaign to increase two-way trade and investment with African countries.2 In April 2021, U.S. Secretary of State Antony Blinken held virtual meetings with Kenyan President Uhuru Kenyatta, Kenyan Cabinet Secretary for Foreign Affairs Ambassador Raychelle Omamo, Nigerian President Muhammadu Buhari, and Nigerian Foreign Minister Geoffrey Onyeama to discuss mutual goals and shared concerns.3

It is critical that the United States works to rebalance its relations with African countries, especially as the continent undergoes dramatic demographic and economic changes. Africa’s population is expected to double to 2.5 billion by 2050, accounting for more than one-quarter of the global population.4 In addition, prior to the COVID-19 pandemic, the continent was home to 7 of the world’s 10 fastest-growing economies.5 As Africa expert Judd Devermont argues, “every global problem is going to have an African dimension to it.”6 From climate change and pandemic responses to cyber governance, African countries are sure to play a significant role in the future of global affairs.

Chinese engagement across Africa is important because it is meeting the needs of one or more powerful local constituencies, from the creation of jobs to providing needed technology and related infrastructure.

U.S. policymakers must realize that if they are unable to advance U.S.-Africa relations in the near future, they will miss a crucial opportunity to participate in a rapidly changing region where American national interests are at stake. Most importantly, the United States cannot continue to rely solely on a strategy of criticizing Beijing’s engagement across Africa. This report outlines five key realities of China’s role in Africa that U.S. policymakers need to understand in order to get U.S. Africa-focused policy right:

- Africans view the United States and China favorably.

- Chinese economic activities across Africa are not solely extractive and create jobs.

- The claim that China is engaged in so-called debt trap diplomacy lacks evidence, but transparency is still a key concern.

- Chinese state financing is paving the way for Chinese companies to dominate telecommunications infrastructure development in many African nations.

- Chinese commercial activity has harmed the environment in many African countries.

American officials need to understand China’s activities in Africa to contextualize their own policy and, in some cases, learn from Chinese successes and failures. Fundamentally, Chinese engagement across Africa is important because it is meeting the needs of one or more powerful local constituencies, from the creation of jobs to providing needed technology and related infrastructure. This report offers recommendations for U.S. policymakers to advance their own positive agenda in Africa by meeting Africa’s needs. These needs include increasing donations of COVID-19 vaccines to African countries, helping African partners develop local laws to improve outcomes from foreign investment and lending, institutionalizing the U.S.-Africa Leaders Summit, and forming and funding an export-credit coalition to provide alternatives to Chinese government lending.

Africans view the United States and China favorably

While U.S. policymakers warn the American public and the rest of the world of the dangers of Beijing’s influence, populations in many African countries do not see Chinese engagement in the same light. The latest public attitudes surveys, conducted in 18 African countries between 2019 and 2020 by the nonpartisan research institution Afrobarometer, reveal that perceptions of China’s political and economic influence across the continent are positive.7 For example, 59 percent of individuals interviewed believe China’s economic and political influence is “somewhat or very positive.”8

HOW AFRICANS VIEW THE UNITED STATES AND CHINA

59%

Percentage of respondents who viewed Chinese economic and political influence favorably

58%

Percentage of respondents who viewed U.S. political and economic influence favorably

Comparatively, 58 percent of those interviewed think the United States has a “somewhat positive or mostly positive” economic and political influence in their home countries, showing that despite seeming neglect on the U.S. side, America is still viewed positively among African populations.9 In fact, a higher percentage of survey participants believe China’s economic and political influence is “somewhat negative or very negative” than believe the same regarding the United States—15 percent to 13 percent, respectively.10 The average level of “somewhat positive or very positive” views on China’s economic and political influence has also dropped slightly across Africa over the years. Afrobarometer’s 16-country poll average from 2014 to 2015 was 65 percent.11 Currently, the 18-country poll average stands at 60 percent.12

The African public surveyed sees neither the United States nor China as a strong model for future development. However, when asked to pick the country that represents the best model for future development, it gave the United States the highest percentage of the vote: 32 percent of respondents chose the United States, while 23 percent chose China.13

Despite the resources the Chinese government has dedicated to fostering China-Africa relations, what China offers is not perceived as overwhelmingly better than what’s offered by the United States. At the U.N. General Assembly in September 2017, nine African leaders told then-President Trump that “we would prefer to do business with the United States and other western countries, but you aren’t there … unlike China.”14 (emphasis added)

Moving forward, U.S. policymakers should track how individual African countries react to Washington’s and Beijing’s handling of the COVID-19 pandemic and race issues, areas where both countries have mixed records. African leaders have criticized both governments for their handling of the pandemic.15 For example, Nigerian Cabinet Minister Oby Ezekwesili criticized China for its mismanagement of the outbreak and demanded Beijing compensate Africa for damages caused by the pandemic.16 Further, the African Group, a regional group at the United Nations composed of 54 member states from the African continent, backed the European Union’s resolution calling for an independent inquiry into the origins of the coronavirus pandemic.17 African leaders also openly criticized Trump for his tweets claiming that the World Health Organization, led by Ethiopian Dr. Tedros Adhanom Ghebreyesus, was “China centric.”18

African leaders have voiced deep reservations about both Chinese and U.S. race policies. In 2020, officials in Nigeria and Ghana voiced their concerns regarding discrimination targeting Africans in Guangzhou.19 The murder of George Floyd also evoked critical responses from African leaders such as Ghanaian President Nana Akufo-Addo, who took to Twitter to say, “It cannot be right that, in the 21st century, the U.S., this great bastion of democracy, continues to grapple with the problem of systemic racism.”20

As concerns over Chinese influence in Africa grow among U.S. policymakers, it is critical to realize that positive perceptions in African countries toward China do not drastically outpace those toward the United States. There is strong evidence that African citizens and governments are open to partnering with the United States over China if American leadership shows up and delivers.

Chinese activity creates jobs in Africa, albeit low-skill ones

As the United States has prioritized other regions in foreign policy, China is currently the African continent’s most significant bilateral economic partner. Extensive economic activity has led to concerns that Beijing’s state-owned and private enterprises are exclusively extracting resources from African countries and importing Chinese workers for these projects instead of employing local African labor.

182,745

Number of Chinese workers in Africa as of 2019

However, extensive research shows that Chinese firms in Africa also create jobs for local workers. Field research conducted in 2013 by Tang Xiaoyang, the deputy director of the Carnegie-Tsinghua Center for Global Policy, demonstrates that China-Africa Cotton has created thousands of jobs for local workers in Malawi and Zambia and contracts with more than 100,000 farmers throughout Southern Africa.22 A 2015 survey of 73 different Chinese manufacturing companies across three Ethiopian industrial zones found that Chinese factories employed nearly 28,000 Ethiopians and fewer than 1,500 Chinese expats.23 In other words, approximately 95 percent of the workforce were local hires. Other research from 2015 conducted by scholars at the Hong Kong University of Science and Technology shows that 85 percent of workers across 400 Chinese companies were Africans.24 A 2017 McKinsey & Company study found that in the 4,832 Chinese-owned firms in Africa it surveyed, 89 percent of employees were African—with nearly 300,000 jobs created for local workers.25 The authors of that study argue that if this figure were scaled across their estimate of 10,000 Chinese-owned firms across Africa, Chinese-owned businesses would employ several million Africans. Other research conducted from 2016 to 2019 demonstrates similar findings in Chinese-backed wind energy projects in Ethiopia. Two projects surveyed—Adama 1 and Adama 2, which are responsible for nearly 5 percent of all Ethiopia’s electricity generation—employed roughly 75 percent and 81 percent local workers, respectively, for a total of approximately 2,000 local Ethiopian workers.26

When compared with non-Chinese foreign firms operating in Africa, Chinese enterprises employ close to the same percentage of local workers. A 2016 comparative research project examining 12 ongoing construction projects in Ghana found that hiring practices by Chinese firms were similar to those of other foreign construction enterprises.27 This research analyzed six Chinese-led projects, three foreign-led projects not of Chinese origin, and three Ghanaian-led projects. The Chinese-owned enterprises surveyed employed 90 percent local hires. Other foreign-led projects employed 93 percent local hires. Surprisingly, Ghanaian enterprises had the lowest share of local employees at 85 percent.28 Another project conducted between 2016 and 2017 by researchers at SOAS University of London surveyed 37 firms in Angola and 40 firms in Ethiopia, of which about half were Chinese-owned. In Angola, 74 percent of workers employed by the Chinese firms were local Angolans, while 90 percent of employees in Ethiopia were Ethiopian.29

Despite significant evidence of Chinese-led job creation, however, issues remain with the labor practices of Chinese-firms in Africa. Most notably, Chinese managers do not often promote local Africans to higher ranks within Chinese-owned businesses. According to McKinsey, only 44 percent of local managers at Chinese-owned companies surveyed were African. Frangton Chiyemura, a lecturer in international development, found that top management and technical positions at Chinese-backed wind energy projects in Ethiopia remain dominated by Chinese employees.30 Tang Xiaoyang has also found that the proportion of African employees is often much lower in companies offering high-skill and technical jobs.31

Besides disparities in promotion opportunities, reports have highlighted various instances of alleged labor rights violations and human rights abuses by Chinese companies in Africa. African workers have complained of low wages and poor working and living conditions.32 In a 2020 incident, two Zimbabwean miners were allegedly shot by their Chinese employer during a dispute over wages, when one worker confronted his employer regarding his wages.33 The Zimbabwe Environmental Lawyers Association stated that the incident demonstrated the “systematic and widespread” abuse of workers by the Chinese company.34 One victim was compensated by the mining company following the incident; the company also covered his medical expenses.35 The Chinese Embassy in Zimbabwe said it was “highly concerned” by the case and called for a transparent investigation.36 Unfair Chinese labor practices in Africa have been a source of concern for workers, labor unions, and human rights organizations for decades.37 Human Rights Watch produced a detailed report in 2011 alleging that “Chinese-run copper mining companies in Zambia routinely flout labor laws and regulations designed to protect workers’ safety and the right to organize.”38 The report shed light on poor health and safety conditions, regular 12- to 18-hour shifts of hard labor, and anti-union practices.39 All such activities highlighted in the report represented a gross violation of Zambia’s labor laws.40

‘Debt trap diplomacy’ lacks evidence, but transparency is a key concern

The practice of so-called debt trap diplomacy—the theory that Beijing uses loans to saddle foreign countries with debt in order to force governments to hand over strategic assets such as ports and railways—has gripped many U.S. policymakers.

There is no evidence of the Chinese government seizing an asset in response to an unpaid debt owed by an African government.

Nevertheless, Chinese lending across Africa remains a complex story. The Chinese government is the African continent’s largest bilateral creditor, holding 21 percent of all African debt.46 Researchers at the Johns Hopkins University School of Advanced International Studies China-Africa Research Initiative have found that from 2000 to 2019, Chinese financiers—both public and private—signed $153 billion worth of loans spread across 1,141 loan commitments with African governments and their state-owned enterprises.47 The top five borrowers—Angola ($42.6 billion), Ethiopia ($13.7 billion), Zambia ($9.9 billion), Kenya ($9.2 billion), and Nigeria ($6.7 billion)—held more than 50 percent of all the Chinese loans to African governments.48 Resource-backed lending—loans based on future income from accessing natural resources—accounted for 26 percent of all Chinese loans in Africa from 2000 to 2019.49 Moreover, Angola accounted for 70 percent of China’s resource-secured lending.50

Chinese lending is likely under increased international scrutiny due to President Xi Jinping’s outward foreign policy push, the Belt and Road Initiative (BRI). Despite the international attention the initiative has spurred regarding major infrastructure projects, Chinese lending to African BRI signatories per year has remained static since the public unveiling of the BRI in 2013.51 In fact, Chinese lending to African governments peaked as the BRI was launched.52 Since 2014, the amount of total Chinese lending to Africa has hovered around $10 billion per year, excluding Angola.53

Despite a lack of evidence to support the debt trap narrative, policymakers and researchers cannot be fully confident that China does not conduct debt trap diplomacy because Chinese lending is purposefully opaque. Research led by AidData, a research center at the College of William & Mary, demonstrates that Chinese loan contracts often contain confidentiality clauses that prohibit borrowers from revealing the terms or even the existence of the debt.54 According to AidData’s assessment of 100 loan contracts, most of the contracts prevent borrowers from disclosing contract terms or related information unless required by domestic law.55 These confidentiality requirements are atypical compared with other non-Chinese loans; as AidData concludes, “Borrower confidentiality obligations outside the Chinese sample are rare and narrowly drawn.” AidData also found that nearly 75 percent of Chinese loans identified contain clauses that prevent the debt from being restructured in multilateral settings.56

Warnings about Chinese technology fail to resonate with African governments

U.S. officials have long warned other countries about the dangers of adopting 5G telecommunications and surveillance equipment from Chinese companies over concerns of deep connections to Beijing and its surveillance state.57 However, these warnings do not resonate with many African leaders, as price and basic connectivity outweigh security concerns. Some African leaders have blatantly rejected the merits of U.S. warnings about Huawei, labeling the warnings political. For instance, South African President Cyril Ramaphosa has said the United States is “jealous” of Huawei’s success in 5G.58 Kenya’s Cabinet Secretary for Information and Communications Technology Joe Mucheru summed up U.S. warnings not to partner with Huawei as merely “political postures.”59

W. Gyude Moore, former Liberian minister of public works and current senior policy fellow at the Center for Global Development, clearly lays out the calculus facing African countries. The concern is not about whether Huawei or other Chinese technology firms create security vulnerabilities for critical data but more about “basic connectivity,” said Moore.60 He adds, “It is about connecting each country to the internet in a way that is adequate, dependable and affordable.”

Despite U.S. warnings, Huawei is a mainstay in African telecommunications networks. Huawei has conducted business in Africa since 1998 and now operates in 40 African countries.61 Huawei’s success in Africa is due in part to the company’s access to Chinese state loans. Over the past 20 years, 29 African governments have signed 69 loans with China’s state-owned banks and other financial institutions, worth more than $6 billion, for Huawei projects.62 ZTE, another prominent Chinese telecommunications equipment provider, has had similar state support from Beijing. Since 2000, the governments of 14 African countries have signed 23 loans for projects involving ZTE, worth more than $3.7 billion. Researchers with the China-Africa Research Initiative have identified some of the interest rates for these loans, which are often well below market rates. The interest rates for 28 of the 69 loans involving Huawei are publicly available, at an average interest rate of 2.25 percent. Six of the 23 loans involving ZTE also averaged interest rates of 2.25 percent.63

Cost will continue to be a determining factor in the telecommunications industry. According to China-Africa expert Cobus van Staden, “one of the key reasons African countries have pushed back against pressure to drop Huawei is that the company is involved at every level of internet provision, from undersea cables … to terrestrial networks to selling mobile phones to African consumers.”64 As countries transition to the next generation of telecoms equipment, African governments may need to incorporate at least some Huawei equipment or face the high costs of eliminating Huawei equipment from already-existing networks. Unless U.S. government warnings to avoid technology from Chinese companies are accompanied by financial assistance or a near-peer competitor to Huawei’s service offerings, they will likely continue to fall on deaf ears.

Chinese commercial activity has harmed the environment in many African countries

Chinese activities across Africa raise serious questions about their potential consequences on the environment and climate. Some fallouts from Chinese projects across the continent include the prevalent use of fossil fuels, increased pollution, and heightened incentives for illegal exploitation of natural resources.

Chinese loans have been used to finance coal projects in South Africa, Zimbabwe, Morocco, Malawi, Botswana, and Zambia.65 According to the China-Africa Research Initiative, since 2000, Chinese state-owned banks have supplied $3.7 billion in financing for coal projects in Africa, totaling 6,800 megawatts.66 Many African countries have been eager to proceed with coal-powered energy projects that only China will finance, as they want to meet the energy demand quickly and place less importance on long-term environmental damage and the contribution to climate change. The Chinese government and its lending institutions have recently shown signs of reducing support for coal projects abroad, but it is unclear if this is a temporary, pandemic-related dip or a policy shift.

Another negative externality of Chinese engagement in Africa is environmental degradation and pollution. For instance, Ghana’s leaders, with the help of a Chinese stated-owned enterprise, are attempting to mine bauxite in a world-renowned forest reserve called Atewa. Local activists and water experts say that the mining would taint the water for 5 million people.67 In addition, the mine is expected to have an impact on an estimated 17,400 hectares of protected forest area. According to a 2018 Human Rights Watch report, mining bauxite has had devastating consequences in a number of African countries.68 The report found that mining in Guinea damaged farmlands and water sources and coated crops in dust. Sand mining conducted by a Chinese company, Haiyu Mozambique Mining Co. Lda, has severely affected the housing and living conditions of Nagonha residents in Mozambique and likely significantly contributed to a flood that partially destroyed a coastal village, leaving nearly 300 people homeless in February 2015.69 Haiyu denied responsibility; however, Amnesty International concluded that “all of the available evidence strongly suggests that Haiyu’s mining activities and in particular the way it deposited sand across the landscape placed the coastal village at heightened risk of flooding.”70

Chinese commercial engagement with Africa has also heightened incentives for illegal or damaging—often both—exploitation of natural resources. For example, Chinese demand for African timber has led to significant black-market activity. In 2017, the Environmental Investigation Agency detailed how 1.4 million illegally harvested logs in Nigeria with a market value of $300 million were laundered into China with more than $1 million worth of bribes paid to Nigerian government officials.71 Furthermore, in 2018, Chinese entities owned around 90 percent of Ghana’s industrial fishing fleet despite Ghanaian law forbidding foreign ownership or control.72 This sort of illegal fishing has cost the Ghanaian economy an estimated $65 million per year.73 Illicit fishing operations place Ghana’s fish stocks under pressure, so much so that pelagic fisheries in the region may collapse within three to seven years.74 Lastly, the Chinese market for ejiao, a traditional medicine made from gelatin extracted from boiled donkey skins, has put donkey populations at risk throughout several African countries such as Botswana, Ethiopia, Ghana, and Kenya. For many vulnerable populations, donkeys are a vital labor resource to transport food, water, firewood, goods, and people.75

Although negative environmental impacts have resulted from Chinese economic engagement in Africa, the Chinese government has nonetheless made some positive contributions to Africa’s renewable energy development. In 2014, the Chinese government donated $800,000 worth of solar street lights to Uganda’s Kampala Capital City Authority.76 Moreover, in 2016, the Zambian government signed a loan from the China Development Bank worth $170 million to finance solar-powered milling plants.77 With the help of Chinese contractors, Kenya launched a 50-megawatt solar power plant, one of the largest photovoltaic electricity stations in Africa.78 Looking forward, it will be important to track Chinese energy engagement in Africa following President Xi Jinping’s announcement that China “will not build new coal-fired power projects abroad.”79 While this is a step in the right direction, Xi was not clear if this announcement applies to all forms of financial support, or what it means for Chinese coal-fired power plants already underway.

The double-edged nature of China’s environmental footprint in African countries is best displayed through a Tanzanian case study.80 In 2017, the Chinese government announced that it would stop importing certain types of waste, including unprocessed waste plastics, as of January 1, 2018. This development combined with rising labor costs encouraged some Chinese businesses to look toward Africa for opportunities in the recycling industry. Currently, about 60 Chinese factories are involved in plastic recycling, granulation, and the manufacturing of a variety of plastic products in Tanzania.

Plastic recycling was almost nonexistent in Tanzania before the Chinese factories opened. Interviews with Chinese investors revealed that dozens of local recyclers bought used machines from Chinese factories in order to set up their own smaller trash collection and recycling centers.81 In other words, not only did Chinese factories help Tanzania create a new industry, but they also spurred local workers into starting their own small businesses, further fueling the economy.

However, this seemingly positive development had a negative environmental impact. During extensive field research in Tanzania, Ying Xia, a researcher affiliated with the China-Africa Research Initiative, found that “most plastic recycling facilities [we] visited during this research hadn’t installed any waste management systems at all, nor did they provide any protective health or safety equipment for their workers. … Many workshops are located within or near residential areas, where they can easily find temporary workers. There was even one facility we visited that was dumping their discarded materials, like flexible labels, into an open well near a local school’s soccer playground.”

Recommendations

The United States has ample opportunity to improve its economic and security partnerships in Africa and an urgent need to do so in the context of U.S.-China competition. But much of what America needs to do to counter Chinese influence in Africa has nothing to do with China. Instead, the United States must take basic steps to improve its performance in Africa as a reliable partner.

Regardless of the contours of U.S.-Africa relations and the rivalry between Washington and Beijing, a historic pandemic is raging. African countries need better access to COVID-19 vaccines, and the United States is an ideal partner to help provide critical assistance in a time of need. This can be accomplished by:

- Donating more vaccines. To date, just 4.3 percent of all Africans are fully vaccinated.82 As the COVID-19 pandemic continues to rage outside developed countries, U.S. policymakers must find a way to increase vaccine donations to African countries. Of the 72 million doses delivered to Africa from the Chinese government, only 11 million have been donations.83 African nations have had to buy almost 85 percent of their Chinese vaccines.

Next, U.S. policymakers must carefully thread the needle between articulating a positive vision for the future of U.S.-Africa relations independent of rivalry with Beijing while also offering policy solutions that mitigate challenges catalyzed by Chinese engagement across the continent. Toward these ends, this report recommends the following:

- Drop the lecturing rhetoric. U.S. policymakers’ warnings of Chinese debt traps, imported Chinese workers stealing local jobs, and security concerns related to 5G technologies do not resonate with African leaders. The first step toward articulating a positive vision for the future of U.S.-Africa relations must include dropping paternalistic rhetoric based on false assumptions.

- Refocus existing aid and development programs in Africa:

- Develop a sectoral focus and targeted incentives for the Prosper Africa initiative. The Prosper Africa initiative, which aims to increase two-way trade and investment between the United States and African countries, should focus on two to three priority sectors and experiment to find the right combination of financial and commercial diplomacy support to boost U.S. participation.84 Originally developed under the Trump administration, the initiative as it stands lacks specific directives or incentives to boost U.S. business interests. U.S. policymakers can better facilitate increased trade and investment linkages by helping direct businesses to the most attractive opportunities and increasing financial support and small-business knowhow in the region.

- Increase funding and support for Power Africa. Former President Barack Obama’s signature Africa-focused initiative, supported by the Electrify Africa Act of 2015, sought to bring market-based sustainable electricity development solutions to 50 million people in Africa by 2020, a goal it reached easily. The Biden administration should undertake a review of this successful program and work with Congress to significantly expand funding support.85

- Announce the return of the U.S.-Africa Leaders Summit. Last held in 2014, the Leaders Summit should be a permanent fixture of U.S.-Africa relations that is planned by career staff at the State Department in collaboration with the African Union. It will demonstrate a high-level commitment to furthering ties between Washington and African capitals. If the summit is held once every four years, each sitting U.S. president will be ensured to host or attend the event once during their term of office. Comparatively, Japan hosts the Tokyo International Conference on African Development once every five years, while China hosts the Forum on China-Africa Cooperation once every three years.

To further demonstrate high-level commitment, the United States should establish diplomatic reciprocity by suggesting the next summit be hosted by a key African partner in 2022, or when it is safe to travel again given the COVID-19 pandemic. In order to improve political buy-in within the United States and bureaucratic longevity for the summit, the Biden administration may want to include bipartisan congressional and key cultural figure attendance and request multiyear funding support for the summit in the fiscal year 2023 budget.

- Strengthen educational and person-to-person exchanges. The United States should expand the Fulbright Program; increase EducationUSA funding targeted to encourage more Africans to enroll in U.S. universities; and increase International Visitor Leadership Program funding in key African nations.86

- Encourage more government-to-government contact across departments. The United States should approve more high-level African delegations to visit Washington while also increasing high-level U.S. government travel to African countries, especially those involved in trade. The U.S. trade representative should prioritize long-term discussions with the African Continental Free Trade Area, both to encourage the area’s effectiveness and to gauge the potential for future trade talks. When safe, the U.S. secretaries of commerce, agriculture, and energy should undertake a trade mission to key African nations. The United States should also significantly increase contact between the U.S. Centers for Disease Control and Prevention and the recently established Africa Centres for Disease Control and Prevention and finance work not just on infectious diseases but also on noncommunicable diseases, environmental health issues, natural disaster response, and capacity-building in member states.

Finally, Chinese engagement in Africa—through Chinese government initiatives, state-owned enterprises, and private Chinese firms—presents both opportunities and risks for partner governments on the African continent. The United States should help African partners mitigate the negative aspects of that engagement by:

- Partnering with African governments to help develop laws that address challenges brought about by China’s economic engagement. China’s engagement with African countries poses risks and challenges to key interests such as transparency, labor practices, and environmental sustainability. As such, the United States should help African countries develop local laws and standards to mitigate these risks. As previously noted, Chinese government lenders themselves have imposed confidentiality requirements on partner countries to not reveal details of loans unless required by local law. Therefore, the United States should partner with African governments to develop pertinent local laws. These efforts should span different issues such as labor practices, to ensure that local African workers are able to reach management positions and receive technical training, and environmental standards, to mitigate damage done to local environments.

- Forming a coalition of export credit agencies to support vendors seeking to compete against Huawei and Chinese state-backed loans.87 U.S. policymakers should stop warning African countries against partnering with Chinese technology companies for telecommunications equipment without offering price-competitive alternatives. To date, U.S. warnings have not resulted in any African governments switching from Huawei or ZTE. To offer an alternative, the United States, together with other countries, should seek to create competition in the 5G arena through a coalition of export credit agencies.

Conclusion

The soon-to-be eighth Forum on China-Africa Cooperation demonstrates Beijing’s high-level commitment to developing partnerships with countries across the African continent. Despite Beijing’s long-term focus on becoming the partner of choice in Africa, the United States still enjoys comparable public support and a strong foundation for significant economic and security partnerships on the continent. U.S. policymakers should focus on developing a positive vision for the future of America’s role in Africa rather than relying solely on criticizing China’s engagement.

About the author

Jordan Link is the China policy analyst for National Security and International Policy at the Center for American Progress. He focuses on understanding the strategic and economic challenges that the Chinese Communist Party presents for the future of American foreign policy.

Before joining CAP, Link worked as the research manager of the Johns Hopkins School of Advanced International Studies China-Africa Research Initiative, where he led the China-Africa loans database research team and conducted quantitative and qualitative studies of China-Africa trade, finance, and security affairs. He also worked at National Defense University’s Center for the Study of Chinese Military Affairs.

Link has an M.A. in Asian studies from the Elliott School of International Affairs at The George Washington University and a B.A. in international relations from the College of William & Mary.

Acknowledgments

The author would like to thank Laura Edwards, CAP program associate for China policy, and China research interns Anna Lipscomb and Patrick Yu for their invaluable research support.