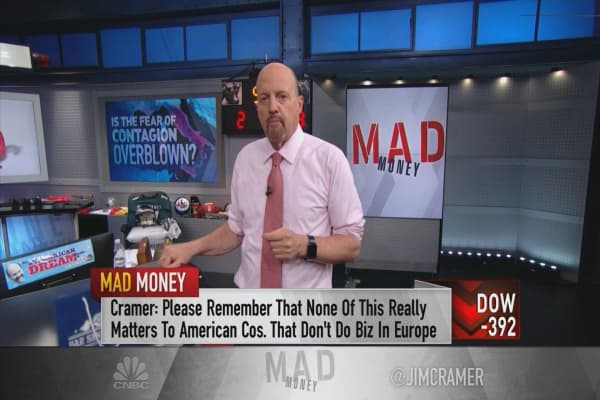

The European-inspired panic that brought down the stock market on Tuesday will ultimately turn out to be a buying opportunity, CNBC's Jim Cramer said.

The Dow Jones industrial average sank 391.64 points, or 1.58 percent, to close at 24,361.45 on Tuesday. The S&P 500 fell 1.16 percent to close at 2,689.86, while the Nasdaq composite fell 0.5 percent to finish at 7,396.59.

"Our market gets crushed and everyone acts like the world is about to end," the "Mad Money" host said Tuesday.

Yet "this stuff is good ... for most American companies because it pushes down our interest rates. In fact, I think this European turmoil is absolutely positive for the United States," he added.

However, the market got slammed anyway, namely for three reasons, Cramer said.

One, the market hates uncertainty. Second, people think that a crisis overseas will eventually mean a crisis here. Lastly, investors were looking for any excuse to take some profits, he argued.

Once the panic settles, Cramer sees several reasons to buy.

The negativity and fear has caused interest rates to go down fast, for one. If the yield on the 10-year Treasury sinks to 2.75 percent, which Cramer predicted last week, it would be ultimately terrific for most of the stock market, he said.

Plus, the plunging oil prices are good for retail names and consumer packaged goods companies. Meanwhile, he thinks the strong U.S. dollar, which can hurt those companies, is a side issue.

Finally, Cramer believes the sellers of the S&P 500 today will be the buyers of the small and mid-cap domestic stocks tomorrow.

"Anything that gives us lower rates, lower inflation, more powerful banks, and more purchasing power for homes and cars, is something that's good, not bad," he said. "We just have to wait until the sellers come to their senses and realize that sometimes uncertainty can lead to good outcomes."