今天看了一篇文章,作者在2009年的市场最低点的附近买入了TD股票,在本季度TD增加红利以后,他的TD持股的红利YOC已经达到了10%。我的一些同事朋友常常会对我说,如果他们要是在市场最低点买到了TD,一定会长期持有,就再也不卖了,在他们看来有运气买到最低点是最重要。当然,他们大都非常诚实地承认自己是不可能有这样的好运气的。

今天2018-3-12的TD价格比三年前高出了50%以上,所以如果三年前买入TD,今天卖出一半股份,那么从资本投入来说,本金是现在股价的45%,红利现金的YOC大概是8%左右, 这就比较接近于前面的2009年市场最低点买入的情况。

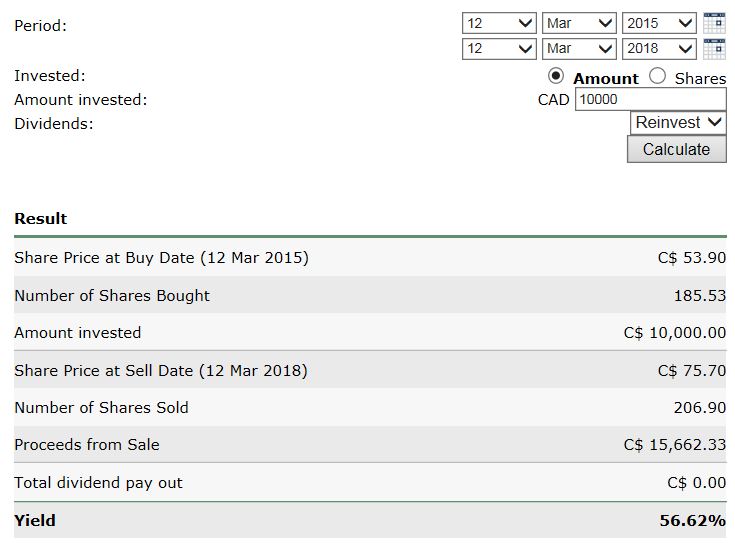

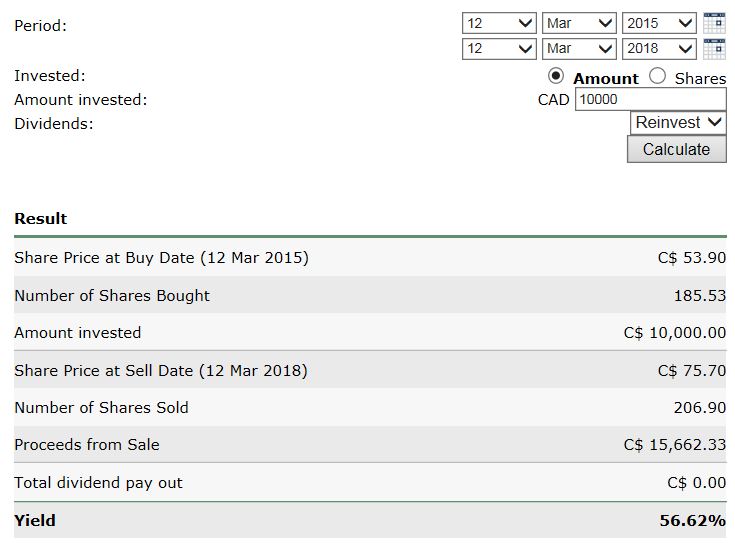

TD的长期ROE是13-16%之间,假设均值为15%,三次方是52%,所以2015-03-12和2018-03-12三年时间的增值幅度不是特例,是长期均值状态。

2015-03-12 2018-03-12 56.62%

2012-03-12 2015-03-12 45.83%

2009-03-12 2012-03-12 123.34%

2006-03-12 2009-03-12 -31.09%

2003-03-12 2006-03-12 126.13%

2000-03-12 2003-03-12 -4.75%

1997-03-12 2000-03-12 96.55%

1994-03-12 1997-03-12 100.72%

1991-03-12 1994-03-12 39.93%

1988-03-12 1991-03-12 41.65%

1985-03-12 1988-03-12 62.53%

1982-03-12 1985-03-12 142.75%

1979-03-12 1982-03-12 45.33%

1976-03-12 1979-03-12 37.57%

1973-03-12 1976-03-12 18.45%

三年投资回报的长期平均值是60.10%,无论是选择哪一年为起点,结果基本会相同。

从长期看,有80%的随机概率可以成功实现理想中的战略目标,所以从投资者的角度,运气并不重要,即使完全没有运气,也可以大概率的成功。

人生中的一个个选择总可以有从战略的或者战术的角度去选择,从战术战役的角度看问题就不免拘泥于一城一地的局部得失。从战略的角度去看问题则是不断从一个个旧的平衡走向一个个新的平衡。- 《罗辑思维》

在投资上,技术要从属于策略,策略要从属战略,战略最终从属于信念和价值观。投资失败和成功的程度,技术层的影响其实很小,策略层的影响有限,大部分结果取决于投资战略是否正确和基本信念的牢靠程度。但绝大多数人每天的眼里都是技术,几天换一个策略,从不思考战略,永远未曾理解和坚守信念。- 水晶苍蝇拍的博客

大致上,所有长期表现良好的蓝筹股,都会有与TD类似的股价波动情况,这不是特例,而是资本的运行的必然规律。股票的股价波动长期必须回归公司的经营业绩,长期回报均值必然与生意模式的长期ROE 对等,这是资本世界的自然规律。

有一位同事曾经多次对我说,如果再有一次08这样的市场危机,他一定把所有的钱都投入到市场,然后一直持有。我觉得即便是真的再有一次08这样的市场波动, 他也多半不会成功的,因为他已经经历过好几次大的市场危机了。

From an interview with Charlie Munger at the University of Michigan Ross School of Business. For a couple of hours, Munger talks in front of a large audience to Becky Quick of CNBC then takes questions from students and faculty.

毫无疑问,在市场中能够以最低价位买入股票的机率是不高的,我自己从来没有过这样的经历,即使是偶而在最低价买到过一些股票,整体仓位的均价都是要比市场的最低价高出许多。

今天2018-3-12的TD价格比三年前高出了50%以上,所以如果三年前买入TD,今天卖出一半股份,那么从资本投入来说,本金是现在股价的45%,红利现金的YOC大概是8%左右, 这就比较接近于前面的2009年市场最低点买入的情况。

TD的长期ROE是13-16%之间,假设均值为15%,三次方是52%,所以2015-03-12和2018-03-12三年时间的增值幅度不是特例,是长期均值状态。

2015-03-12 2018-03-12 56.62%

2012-03-12 2015-03-12 45.83%

2009-03-12 2012-03-12 123.34%

2006-03-12 2009-03-12 -31.09%

2003-03-12 2006-03-12 126.13%

2000-03-12 2003-03-12 -4.75%

1997-03-12 2000-03-12 96.55%

1994-03-12 1997-03-12 100.72%

1991-03-12 1994-03-12 39.93%

1988-03-12 1991-03-12 41.65%

1985-03-12 1988-03-12 62.53%

1982-03-12 1985-03-12 142.75%

1979-03-12 1982-03-12 45.33%

1976-03-12 1979-03-12 37.57%

1973-03-12 1976-03-12 18.45%

三年投资回报的长期平均值是60.10%,无论是选择哪一年为起点,结果基本会相同。

从长期看,有80%的随机概率可以成功实现理想中的战略目标,所以从投资者的角度,运气并不重要,即使完全没有运气,也可以大概率的成功。

人生中的一个个选择总可以有从战略的或者战术的角度去选择,从战术战役的角度看问题就不免拘泥于一城一地的局部得失。从战略的角度去看问题则是不断从一个个旧的平衡走向一个个新的平衡。- 《罗辑思维》

在投资上,技术要从属于策略,策略要从属战略,战略最终从属于信念和价值观。投资失败和成功的程度,技术层的影响其实很小,策略层的影响有限,大部分结果取决于投资战略是否正确和基本信念的牢靠程度。但绝大多数人每天的眼里都是技术,几天换一个策略,从不思考战略,永远未曾理解和坚守信念。- 水晶苍蝇拍的博客

大致上,所有长期表现良好的蓝筹股,都会有与TD类似的股价波动情况,这不是特例,而是资本的运行的必然规律。股票的股价波动长期必须回归公司的经营业绩,长期回报均值必然与生意模式的长期ROE 对等,这是资本世界的自然规律。

有一位同事曾经多次对我说,如果再有一次08这样的市场危机,他一定把所有的钱都投入到市场,然后一直持有。我觉得即便是真的再有一次08这样的市场波动, 他也多半不会成功的,因为他已经经历过好几次大的市场危机了。

From an interview with Charlie Munger at the University of Michigan Ross School of Business. For a couple of hours, Munger talks in front of a large audience to Becky Quick of CNBC then takes questions from students and faculty.

Becky began the interview by asking Charlie for his thoughts on the economy.

"Warren and I have not made our way in life by making successful macroeconomic predictions and betting on our conclusions.

Our system is to swim as competently as we can and sometimes the tide will be with us and sometimes it will be against us. But by and large we don't much bother with trying to predict the tides because we plan to play the game for a long time.

I recommend to all of you exactly the same attitude.

It's kind of a snare and a delusion to outguess macroeconomic cycles...very few people do it successfully and some of them do it by accident. When the game is that tough, why not adopt the other system of swimming as competently as you can and figuring that over a long life you'll have your share of good tides and bad tides?"

一个理性的投资者,无论未来市场如何波动,都是大概率的会投资成功。

"Warren and I have not made our way in life by making successful macroeconomic predictions and betting on our conclusions.

Our system is to swim as competently as we can and sometimes the tide will be with us and sometimes it will be against us. But by and large we don't much bother with trying to predict the tides because we plan to play the game for a long time.

I recommend to all of you exactly the same attitude.

It's kind of a snare and a delusion to outguess macroeconomic cycles...very few people do it successfully and some of them do it by accident. When the game is that tough, why not adopt the other system of swimming as competently as you can and figuring that over a long life you'll have your share of good tides and bad tides?"

一个理性的投资者,无论未来市场如何波动,都是大概率的会投资成功。

The market, like the Lord, helps those who help themselves.

But, unlike the lord, the market does not forgive those who know not what they do. - 巴菲特