子夜读书心筆

写日记的另一层妙用,就是一天辛苦下来,夜深人静,借境调心,景与心会。有了这种时时静悟的简静心态, 才有了对生活的敬重。

Global Markets in Review: Mixed Markets as Investors Weigh Data by Prieur du Plessis

“Words from the Wise” this week comes to you in a shortened format as I do not have access to my normal research resources while on the road in Europe (also see my post “Gone A.W.O.L. - to Slovenia and Switzerland“). Although very little commentary is provided, a full dose of excerpts from interesting news items and quotes from market commentators is included.

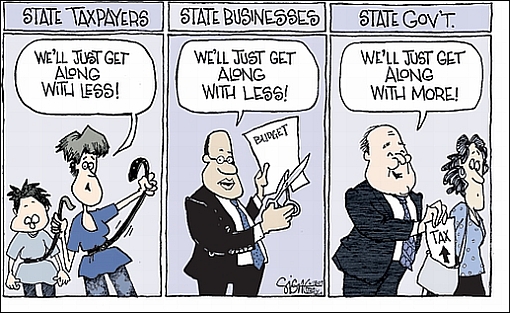

While investors’ hopes of an economic recovery might have got ahead of reality, the cartoonists continually reminded us of worrisome issues …

Source: Signe Wilkinson, Washington Post, June 18, 2009.

The past week’s performance of the major asset classes is summarized by the chart below - a mixed bag so to speak.

Source: StockCharts.com

A summary of the movements of major stock markets for the past week, as well as various other measurement periods, is given below. Although many indices saw little change, some short-term swings occurred in between.

Click here or on the table below for a larger image.

Stock market returns for the week ranged from top performers Côte d’Ivoire (+7.5%), Hong Kong (+3.8%), Taiwan (+3.5%), Argentina (+3.3%) and Bangladesh (+3.0%), to Ghana (-12.7%), Egypt (-11.1%), Nigeria (-10.7%), Cyprus (-6.6%) and the United Arab Emirates (-6.1%) at the other end of the scale. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the leaders for the week included iShares MSCI Taiwan Index (EWT) (+6.6%), Market Vectors Gold Miners (GDX) (+5.9%) and iShares MSCI Hong Kong (EWH) (+4.4%). On the other side of the performance spectrum, laggards were centered in the energy sector, including United States Gasoline (UGA) (-5.9%) and iShares Dow Jones US Oil and Gas Exploration (IEO) (-5.2%).

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “bank”, “financial”, “economy”, “Fed”, “growth” and “prices” featured prominently.

Back to the stock markets: the key moving average levels for the major US indices are given in the table below. The indices are all trading above the 50-day moving average, but whereas the S&P 500 Index, Nasdaq Composite Index and Russell 2000 Index are also trading above their respective 200-day lines, the Dow Jones Industrial Average and the Dow Jones Transportation Index are still below this key line. In order for a major uptrend to manifest itself, an upturn in the 200-day average itself also needs to take place.

Click here or on the table below for a larger image.

For more discussion on the direction of stock markets, see my recent posts “Richard Russell: Competitive devaluations to spur on gold“, “Video-o-rama: Potpourri of bulls and bears“, “Global stock market declines - threatening moving averages“, “Bill King: Deflation trade back in vogue” and “Technical talk: Seasonal trends less bullish“. (And do make a point of listening to Donald Coxe’s webcast of June 26, which can be accessed from the sidebar of the Investment Postcards site.)

Economy

“Businesses are growing steadily less dour. Global business sentiment improved last week to its best level since last October. Confidence remains consistent with a continued global recession, but the downturn is moderating,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com. “Businesses are notably more optimistic regarding the outlook towards year’s end; expectations regarding the outlook are as strong as they have been since summer 2007 when the financial crisis began.”

Source: Moody’s Economy.com

A snapshot of the week’s US economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

June 26

•Strong increase in Personal Income is temporary, Consumer Spending on track for decline in Q2

June 25

•Q1 real GDP minor upward revisions, outlook for Q2 unchanged

• Jobless Claims - temporary setback or reversal of improvement?

June 24

• Sales of new homes - mixed bag of news

• Durable Goods Orders gather momentum, but shipments remain weak

June 23

• Existing home sales - inventories are declining

June 22

• Capital stock of the US economy - history

The Federal Open Market Committee (FOMC) announced no change to monetary policy following its meeting on Wednesday. The communiqué said the Committee expected to keep the Fed funds rate target in the 0-0.25% range “for an extended period”. However, the comments regarding the current economic situation were somewhat more optimistic, saying that “the pace of economic contraction is slowing”.

The Fed’s quantitative easing programs remained unchanged, targeting the purchase of mortgage-backed securities ($1.25 trillion), agency debt ($200 billion) and long-dated Treasury securities ($300 billion).

Summarizing the U.S. economic outlook, Asha Bangalore (Northern Trust) said:

We are projecting a contraction of real GDP in the second and third quarters and a small increase in the final three months of 2009. The unemployment rate is expected to peak in the first half of 2010, while inflation will not present problems until 2011/2012.

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

Jun 23 | 10:00 AM | Existing Home Sales | May | 4.77M | 4.85M | 4.82M | 4.66M |

Jun 24 | 8:30 AM | Durable Orders | May | 1.8% | -1.1% | -0.9% | 1.8% |

Jun 24 | 8:30 AM | Durable Orders, Ex-transportation | May | 1.1% | -0.6% | -0.5% | 0.4% |

Jun 24 | 10:00 AM | New Home Sales | May | 342K | 365K | 360K | 344K |

Jun 24 | 10:30 AM | Crude Inventories | 06/19 | -3.87M | NA | NA | -3.87M |

Jun 24 | 2:15 PM | FOMC Rate Decision | - | - | - | - | - |

Jun 25 | 8:30 AM | Initial Claims | 06/20 | 627K | 600K | 600K | 612K |

Jun 25 | 8:30 AM | Q1 GDP - Final | Q1 | -5.5% | -5.7% | -5.7% | -5.7% |

Jun 26 | 8:30 AM | Personal Income | May | 1.4% | 0.2% | 0.3% | 0.7% |

Jun 26 | 8:30 AM | Personal Spending | May | 0.3% | 0.3% | 0.3% | 0.0% |

Jun 26 | 8:30 AM | PCE Core | May | 0.1% | 0.2% | 0.1% | 0.3% |

Jun 26 | 9:55 AM | Michigan Sentiment -Revised | Jun | 70.8 | 68.8 | 69.0 | 68.7 |

Source: Yahoo Finance, June 26, 2009.

Across the pond the European Central Bank (ECB) will make an interest rate announcement (Thursday, July 2), while in the U.S. economic highlights for the week include the following:

Source: Northern Trust

Click here for a summary of Wachovia’s weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, June 26, 2009.

“Never spend your money before you have it,” said Thomas Jefferson (hat tip: Charles Kirk). And when you do have it, let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will help you to invest wisely.

That’s the way it looks from Slovenia’s delightful capital, Ljubljana - pronounced “Loob-li-yana” and meaning “the beloved” - where I will be spending the next week.